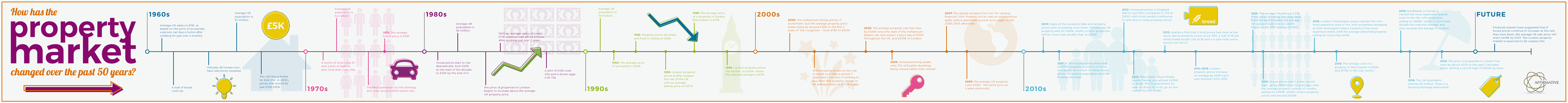

How has the property market changed?

Everything you need to know about the property market over the past 50 years.

Property prices have recently reached the highest recorded in history, with industry experts predicting that things are only going to further escalate over the next five years. Following the startling announcement in April 2016 that the average property in the UK now costs £300,000, more and more people looking to get their foot on the property ladder are expected to face further challenges.

George Osborne’s proposition to increase Stamp Duty on second-home and buy-to-let purchases came into effect in April 2016, resulting in frenzy within the property market, with investors and homeowners rushing to buy before the change.

Due to a rapidly increasing population every decade (up by more than 12 million in the past half-century), the property market reached a nationwide standstill by 2016, with a shortage of homes and escalating prices resulting in many choosing to stay at home or rent in a houseshare for longer.

Since the 1960s, property prices have risen at a steady rate. However, after the millennium there was a particularly dramatic spike, with properties more than doubling in price, the one exception being during the aftermath of 2007’s recession.

Industry experts have predicted that the average UK house will reach £419,000 by 2025 – whether this continues to be the position following the UK’s vote to leave the EU remains to be seen.

Now, we look back at the major events and changes that have shaped the property market over the past fifty years.